Most individuals find investing in Bitcoin and other cryptocurrencies to be daunting. This is because the bitcoin industry has been portrayed as a highly technical financial industry to the general public.

That, however, is not the truth. As long as you follow the proper rules, you may begin trading or investing in cryptocurrencies in no time. The proper procedure begins with selecting the bitcoin exchange to utilise. Crypto exchanges serve as your entry point into the cryptocurrency market. As a result, they are crucial. And today, we will be discussing how you can choose the best bitcoin exchange for yourself to start trading. So, let’s get started.

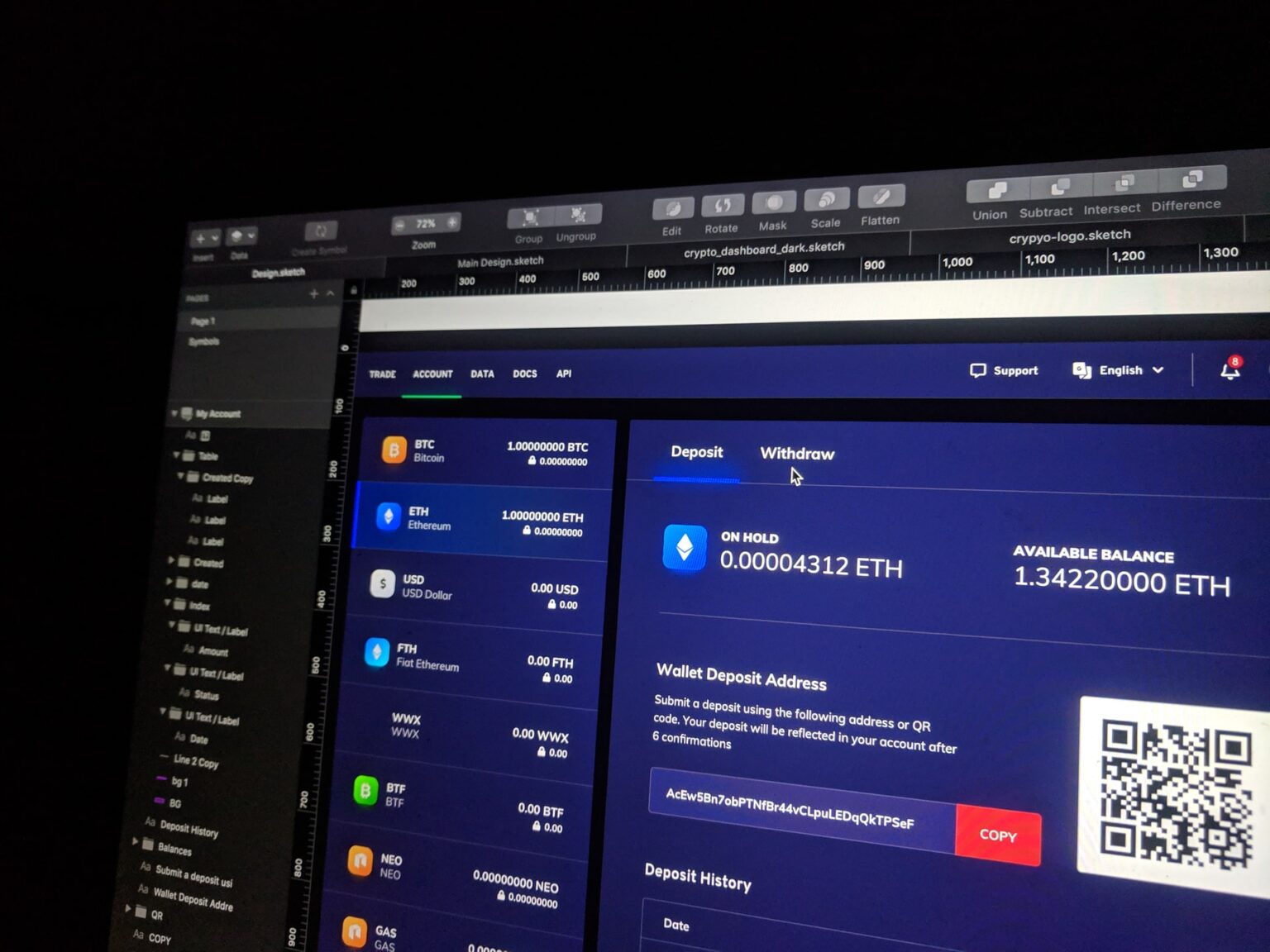

WHAT ARE CRYPTOCURRENCY EXCHANGES?

Crypto exchanges are marketplaces where users may purchase and sell cryptocurrencies such as Bitcoin. You may use the platforms to change one virtual currency to another – for example, Bitcoin to Ether – or buy the cryptocurrency using conventional fiat currencies such as USD or GBP. These sites are based on the current market pricing of the cryptocurrencies they provide. Users may also utilise an exchange to transfer their cryptos back to fiat currencies, providing them with the choice of withdrawing the cash to their standard bank account or leaving them on the exchange platform to swap back into digital currencies later. For more advanced trading options, you can explore platforms that offer innovative features like Quantum AI login.

Thousands of bitcoin exchanges and software like Bitcoin Code are available to traders and investors. As a result, selecting the best ones is difficult but not impossible. Just look for the factor mentioned below when choosing the perfect exchange, and you can well enter the crypto market.

THINGS TO CONSIDER WHEN SELECTING A CRYPTO EXCHANGE:

- THE PLATFORM’S CREDIBILITY AND SECURITY:

Carry out extensive research to know if the exchange you are considering is a genuine and protected platform. The early example of Mt. Gox and the most recent hacking of Coincheck serve as severe cautions to potential virtual currency investors to investigate the safety procedures of the platform. The legitimacy and safety of a platform will assist you in determining if your assets are secure with the cryptocurrency exchange. Scam sites have cost investors billions of dollars. As a result, make sure to evaluate the platform’s reputation as well as the numerous security mechanisms in place to safeguard your details and finances.

- THE METHOD OF PURCHASING COINS:

The method of obtaining cryptocurrency differs depending on the platform. Some platforms offer bank transfers for deposits, some take credit and debit cards, while others solely accept virtual currency for transactions. Examine the many payment choices offered on the sites and select the one that is best for you. To begin, with no cryptocurrencies, it is critical that you select a platform that takes fiat cash since this enables you to enter the industry with less stress.

- SUPPORTED TOKENS AND COINS:

Most marketplaces support Bitcoin and Ethereum, but digital currency investors are fully aware that this is only the tip of the iceberg. There is a massive difference in the digital currencies supported by various exchanges; some platforms trade a vast list of altcoins, whilst others exclusively trade prominent cryptocurrencies. However, there are hundreds more cryptocurrencies, and some investors desire to diversify beyond BTC and ETH. As a result, before selecting a crypto exchange, you should be familiar with the currencies and tokens it supports.

- THE PLATFORM’S FEE STRUCTURE:

When selecting a bitcoin exchange, you must consider the fees structure. Find out how much you’ll have to spend in fees for all sorts of trades on that platform. If you are a novice trader with a modest trading volume, choosing a cheaper fee exchange may be worthwhile. However, as your trading skills and volume increase, you may find that you would like to get an advantage by paying a higher transaction fee with superior cryptocurrency exchanges. Evaluating a crypto exchange’s fee structure is critical since it lets you know what you’re up against while engaging in various activities. Also, choose a platform that does not charge hidden transaction fees.

FINAL THOUGHTS:

When you finally pick a bitcoin exchange, you must consider all of the above considerations. This encompasses security and authentication timeframes, fees, and the amount of financial support they have to assist secure your digital assets. This is a must-do before investing in a bitcoin exchange. Even though there are several variables to examine, you may safely narrow the list by removing exchanges that lack any of these qualities.