New research from LandlordBuyer found that over the last 12 months, average salaries have increased at a greater rate, than average private rental costs.

What do the most recent rental price and the average salary data show?

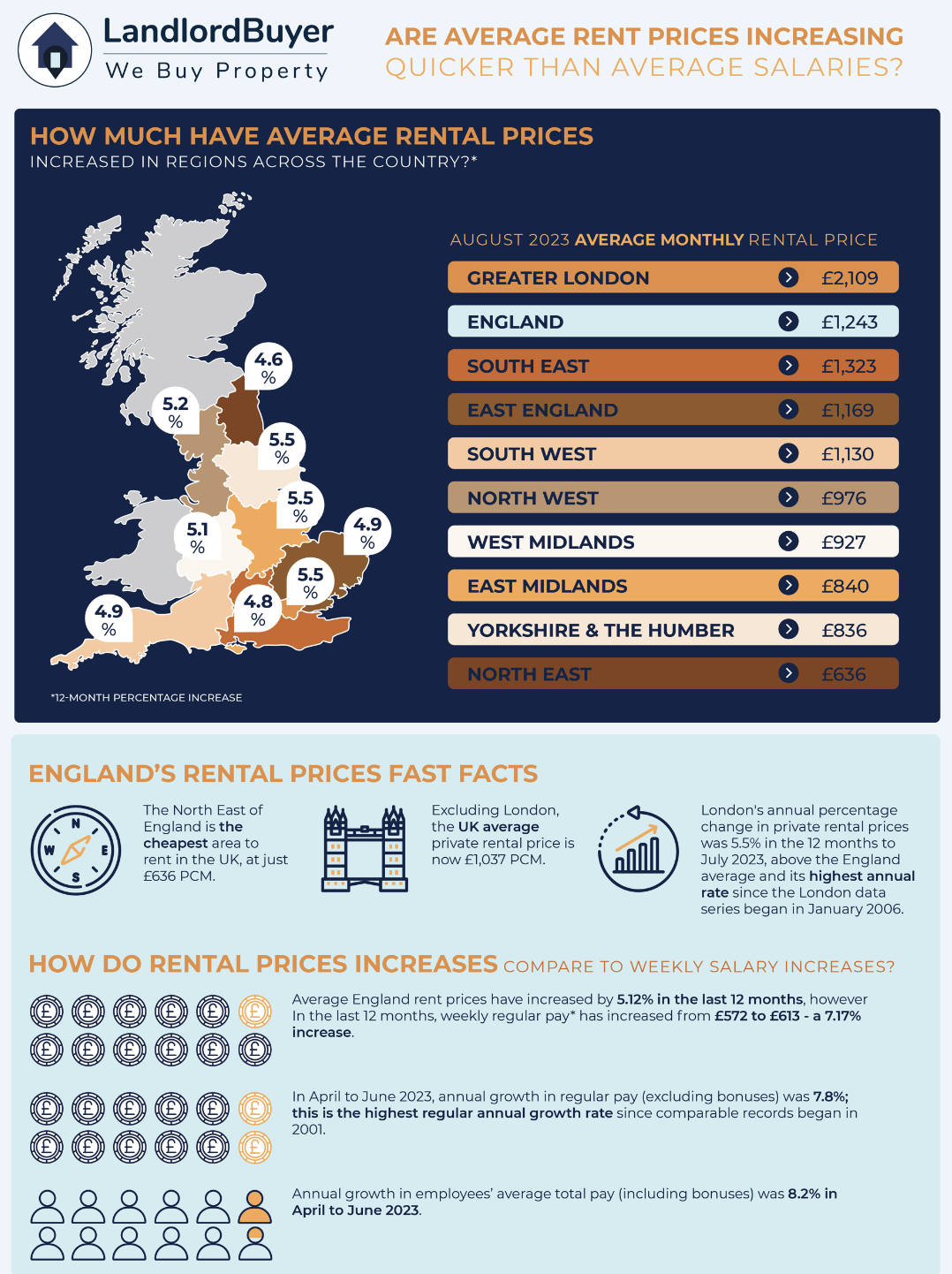

Where are the most affordable regions to rent in the country?

The North East of England tops the charts, where monthly rental prices sit at just £636 per month. This is closely followed by Yorkshire and The Humber where the average rent costs £836/month.

What do Property Experts think about what the future holds with the relationship between salaries and the cost of renting in the country? LandlordBuyer Managing Director, Jason Harris-Cohen says:

“The UK’s rental market is subject to a ‘robbing Peter to pay Paul’ scenario. While rising wages mean tenants have more take-home pay, income increases are being spent on rising rents. There really is no current advantage to getting a pay rise, especially if it pushes someone into a higher take bracket – they could actually end up with less money.

There will be a tipping point in the private rental market and I don’t think it’s that far away. Landlords will not be able to keep raising rents indefinitely. Each area and property type will have its ceiling limit. Breach this and the landlord runs the risk of rent arrears, with many tenants already struggling with living costs. Pitch the rent too low and the landlord won’t be able to cover their own expenses.

Landlords exiting the market is making matters worse. The more that leave, the less choice there is and increased competition for rentals will naturally push rents up.

A backdrop to all of this is higher mortgage rates. Despite lenders cutting rates in late summer and early autumn, the reductions are minimal – there’s still a huge gulf between the circa 2% rates we saw three, four years ago and the new normal of 5-6%. This is going to come as a huge shock to landlords coming off fixed-rate buy-to-let mortgages. Realistically, but-to-let may soon become a small pool of mortgage-free properties and cash-buying landlords.

Property investors looking for a silver lining will know that high mortgage rates also keep tenants in rented accommodation. Even with house prices slowly drifting downwards, many first-time buyers simply can’t afford the deposit, stamp duty, mortgage arrangement fee, legal costs and monthly mortgage repayments needed to become a homeowner. Therefore it was no surprise that Zoopla recently declared renting was cheaper than mortgage repayments for the first time in 13 years.”

About LandlordBuyer

LandlordBuyer are a professional property buyers and landlords. We are flexible, fast-acting investors, and we’ll make an immediate offer for any type of rented property throughout England.

LandlordBuyer are members of the National Landlord Association (NRLA), and the Property Ombudsman. We are committed to providing quality homes to our tenants, and providing a simple service for landlords who want to sell property with sitting tenants.