New tipping laws came into force yesterday – which means workers will now take home 100% of their tips. But how generous are Brits when it comes to tipping?

In reaction the new Tipping Act, I’m getting in touch to share a piece of research into customer attitude towards tipping from the leading digital payment solutions provider takepayments, that I think you’ll find interesting, as well as guidance for businesses on how to make sure they’re conforming to the new rules.

As part of their extensive tipping index survey, takepayments questioned over 2,000 British consumers to explore attitudes towards leaving a tip for workers. The full report can be found here: https://www.takepayments.com/tipping-index/

The study revealed that:

- 1 in 3 stated that they can’t afford to tip workers

- Although 36% of those questioned said they would always leave a tip, 15% said they have reduced the amount they tip since the pandemic, showing the impact the cost of living crisis is still having upon spending habits

- A third of people said they never tip by card as they don’t think it goes to the right person

The respondents who said they always leave a tip, do so for the following reasons:

- to show I’m satisfied with the service (63% selected this)

- because I like the person serving me (50%)

- because it’s common courtesy (33%)

- because I can afford to at the time (33%)

- because there is no service charge added (28%)

- because tips are a big part of some worker’s incomes (28%)

The respondents who said they never leave a tip, do so for the following reasons:

- because the service has already been paid for (34% selected this)

- because they can’t afford it (1 in 3)

- because staff should be paid properly in the first place (13%)

The most generous tippers overall in the UK were:

-

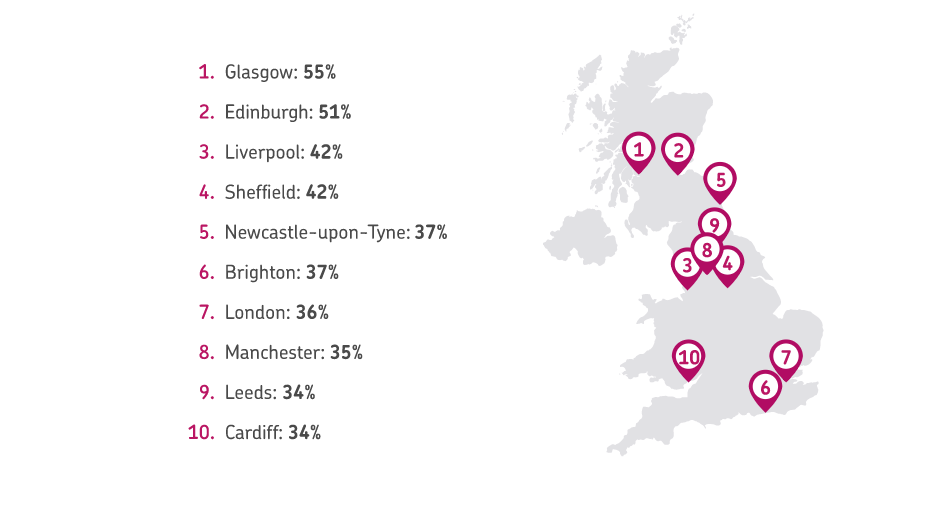

A North South divide was evident in relation to the most generous tippers, with Northern cities, including Liverpool, Sheffield and Newcastle coming out on top for gratuities paid.

-

It was revealed that the most generous tippers can be found in Scotland. Glasgow was the most generous city and 55% of respondents said they always leave a tip, whilst Edinburgh came in 2nd with 51%.

Jodie Wilkinson – Head of Strategic Partnerships at takepayments – has supplied some advice for businesses on how to adhere to the new tipping rules: “In recent years, it’s been raised that some businesses have taken a percentage of their service charges to add to their overall revenue or to cover other expenses. With many hospitality staff members relying on tips to supplement their salaries, it’s been a controversial tactic that’s, understandably, left some staff feeling unfairly rewarded for their service efforts. The Employment (Allocation of Tips) Act 2023, or Tipping Act, will bring in a new Code of Practice around the distribution of tips for businesses in England, Scotland, and Wales and states that employers must demonstrate ‘fairness and transparency’ when accepting and sharing gratuities. The Tipping Act will enforce a new law requiring all tips and service charges to be paid to the member of staff who served the customer that provided the tip, instead of to the business as a whole. Under the new Tipping Act, employers must:

- Give all tips, service charges, and gratuities to workers without deductions, except in very limited situations, like the deduction of income tax

- Share a written policy on how tips are allocated and ensure employees can access it

- Keep a record of all tips paid and their allocation and distribution between each employee. Workers must have the right to request access to this record

It’s also worth noting that under the new legislation, employers can offer employees a different percentage of tips compared to other staff members. For example, front-of-house staff may be allocated more tips than those working back-of-house or those working differing contracts.

If the employer doesn’t comply with the requirements after the law comes into effect, they could be sent to an employment tribunal. The employer may be ordered to revise a previous allocation of tips or pay up to £5,000 in compensation – which may extend to other workers at the business who weren’t involved in the tribunal.”