The rapid and distressing impact the pandemic had on international trade and investment shows how rapidly global markets may be influenced by outside factors. Environmental, Social, and Corporate Governance metrics provide businesses and investors with a new tool for assessing companies in the post-Covid era (ESG). Over the last two decades, talk of “digitalization” has increasingly dominated the corporate discourse. As companies become increasingly conscious of their impact on the world, ESG is no longer seen just through the prism of climate change and carbon reduction. To compete in the new global economic order, firms need to focus more than ever on developing a complete digital strategy. To reduce potentially harmful activities and meet ESG decarbonization goals, several digitalization strategies have emerged in the industry. Companies that have adopted digital transformation to boost profits while also helping the planet, society, and government have reaped the benefits of this strategy.

The environmental, social and corporate strategy (ESG) along with digitization is the twin mega progression redefining preferences and altering business sustainability. The concept of a green post-COVID has spotlighted even more the relevance of those two forces of change for people, the earth and the corporate business. Digital infrastructure and services can be seen as a driver of sustainability if it is heavily fortified at the centre of the organization’s sustainability efforts. ESG are all made effective and possible via the use of information and technology (I&T) in the era of digital sustainability. Enhancing ESG is one of the goals of sustainable technology.

Disruptive Technologies That Are Disrupting the Commercial Status Quo and Gauging the Impact of ESG

Disruptive innovations have increased in recent years, threatening existing businesses and sectors. They’re replacing old technologies while creating new company sectors and consumer marketplaces. Examples of disruptive technologies are – Artificial Intelligence (AI), the Internet of Things (IoT), and blockchain. They streamline internal operations, bridge the digital and physical worlds, and improve brand-customer interactions. When businesses use disruptive technologies, they gain access to new markets, increase their administrative intelligence, boost their performance management efficiency, speed up their operations with fewer mistakes, and spend less time on data-intensive tasks. To better serve their consumers and reduce their exposure to market risk, businesses may now analyze market data in more depth than ever before. However, creative business models that benefit the company and its consumers are essential for the effective adoption of disruptive technology.

The effectiveness of ESG programs depends on the availability of standards that can reliably notify technology companies of the impact of their ESG practices. Corporate social responsibility (CSR) has been at the centre of business strategies for making and assessing social impact for quite some time (CSR). Comprehensive ESG data that may aid in adjusting business operations to promote responsibility throughout the corporation and achieve global sustainability goals are required in this newer level of ESG integration into business objectives. Targeting, monitoring, evaluating, and reporting sustainability performance is difficult, which contributes to a lack of established core indicators in ESG reporting. Voluntary corporate self-disclosure and required company disclosures are replacing independent rating systems, filings, and press coverage as the primary sources for ESG metrics.

A variety of ESG rating systems have evolved to score businesses based on how well they perform ESG-related criteria, allowing for quantification of the ESG effect. Based on the company’s annual report, media coverage, investment analytics, management data, and risk exposure, a numerical score representing ESG performance is generated. In contrast, however, there is currently no accepted methodology for calculating ESG ratings. The primary metrics must be constructed in a way that reflects stakeholder goals and accomplishments beyond the bounds of traditional measures of success.

Key Considerations for Digital ESG

The four most pressing considerations for digital ESG are –Automate (automating data collection), Validate (capturing evidence to validate processes), Mitigate( Benchmarking and analysis) and Navigate (adopting to changes in future). The gathering and reporting of environmental, social, and governance (ESG) information may be difficult for businesses without the aid of modern digital tools. Convene ESG was developed specifically to address this issue. By providing easily accessible forms for provisions and frameworks, this specialized solution facilitates more accurate data recording and consolidation of a company’s ESG performance. Organizations may benefit from its ability to keep eyes on ESG targets and provide reports, which helps them narrow down their focus. On the path toward perpetual sustainability, ESG may be of assistance in several ways. However, managers were able to tailor procedures to provide the public with unique and new products thanks to digital technology without having to adapt their sustainable practices. Simply put, businesses may enhance output without compromising on environmental, social, and governance (ESG) considerations thanks to processing digitalization. This allows them to create bespoke services and goods, for example, without increasing prices or impact on the environment.

Digitalization and ESG

Green software, AI bias, and trusted data are three areas that corporates should begin prioritizing. They will have far-reaching effects on the E, S, and G aspects of the organization in the future. Both ESG and Digital Transformation are concerned with the efficiency and effectiveness with which a company’s operations are carried out and the extent to which they contribute to the well-being of society. Therefore, it is in everyone’s best interest to provide consumers with what they want, whether that means creating novel experiences or focusing on issues that they see as crucial.

- Green Software

Over one per cent of the world’s annual energy consumption is currently used by data centres. Over the next decade, it is expected to skyrocket to 8 per cent of the world’s total energy consumption. Not only do data centres use a great deal of electricity, but they also need a great deal of water for cooling reasons. As the need for data centres increases, so are concerns about their environmental effect. Hardware optimization and the utilization of solar or other renewable energy sources may help alleviate a part of a facility’s carbon impact. The algorithm of eco-friendly software, on the other hand, ensures maximum energy efficiency, making it a potentially enormous advantage.

- Artificial Intelligence

Concerns relating to AI bias are being raised as businesses increasingly use AI in areas as diverse as hiring and customer service. There are serious consequences to practically every deployment scenario when algorithms or AI are biased. Privacy concerns are also raised, particularly in light of the potential for discrimination against minorities and women if too much data is gathered for decision-making purposes due to this prejudice. How are businesses policing the use of AI in personnel decisions when the results might be harmful to individuals? Concerning humans, how much data is too much to collect? Which judgments are we going to give a computer? This whole situation has the potential to become a greater problem with social governance. For instance, one multinational corporation recently issued an apology for what it called an “unacceptable blunder” in which their

- Natural Language Processing (NLP)

Investors use primarily two sources of data to evaluate potential investments. The first set of factors is a firm’s estimates of its environmental, social, and governance (ESG) effect. The second involves comparing a company’s ESG performance against that of its competitors, with the use of independent ESG evaluations. Unfortunately, there are many different approaches to ratings, which may make it difficult to make fair judgments. By combining the aforementioned pieces of information using NLP techniques, we can solve this problem. Technologies, such as blockchain, that allow reliable and consistent ESG data gathering and reporting are also beneficial to investors.

Investment in the ESG Space

The approach of the industry has transformed, from 3P’s – “profit, profit, profit” to the one focusing on “planet, people, and profit”.

Over the last decade, across the globe, there has been an increase in rules about ESG. Corporates/Governments have been emphasizing the matter and developing strategies as business sustainability, equality, and an immaculate environmental record have become critical components of long-term financial success in the market. For instance, Governments across Europe are upgrading their buildings to “nearly zero energy” buildings (nZEBs) by 2050, and have already been asked to prepare long-term decarbonization programs for the same. Europeans have introduced the concept of “double materiality” to describe the inclusion of information on an asset’s financial performance and its influence on environmental, social, and governance problems in financial reports. Financial managers and advisers are required to disclose environmental, social, and governance (ESG) risks associated with their investments under the Sustainable Finance Disclosure Regulation (SFDR) that was approved in Europe in 2019. The US SIF Foundation reports that the total amount of money invested in the United States utilizing sustainable, responsible, and impact (SRI) methods was $8.72 trillion in 2015. This is a 33% increase from 2014 and a 14-fold increase from 1995. That amounts to about one cent in every six dollars in assets.

Zurich Insurance Group, one of the world’s biggest financial asset holders, is the first insurance business to support the UN’s sustainability objectives for 2019. The company has launched two projects to achieve carbon neutrality in investment portfolios by 2050 and reduce its total carbon impact. One of the biggest global independent investment funds in the world, Dubai Investment Fund (DIF), established in 2001, to efficiently manage financial resources by investing in a wide range of growth-oriented asset classes, has been keenly focused on handling responsible investments in ESG’s. They have made significant investments towards ESG to make strides in the fight against climate change and foster healthier workplace cultures investments such as “SkillFuel” and “Kerne” since 2015. Over the years they have been continuously investing in ESG friendly projects such as Healthcare in Norway (2018), Loimua (utility district heating) – Heating up the race to net zero in Europe’s coldest climate Waste-to-Energy (June, 2019), Walloon Street Lighting – Green light to tackle the climate emergency in Walloon (2019), Schools (Social Infrastructure 2019), Renewable Energy Generations Projects across North America (2019), Cascade Power – Utilities (2020), Healthcare (2021), Dublin WtE facility – Inspiring a new era of sustainable waste to energy solutions in Ireland (2019) etc. Not only are they investing in ESG, but they are also raising awareness of the issue via yearly conferences, presentations, and studies on themes including ESG, climate change, innovative technology, and renewable energy. Among other, these strategic decisions have assisted the Dubai Investment Fund to meet the needs of its stakeholders while also protecting the long-term profitability of its assets. In 2014, DIF invested in stocks and owned stakes in such companies like ArcelorMittal SA, China Steel Corp, Nucor Corp and in 2015 – in Facebook Inc., SolarEdge Technologies Inc. and Sunrun Inc. Identifying ESG as the major megatrends, DIF has recently in July 2022 created a dedicated ESG Investment department. The Swiss engineering firm ABB Ltd has announced a partnership with Red Hat Inc to provide scalable digital solutions for the industrial edge and hybrid cloud. Through this partnership, businesses using ABB’s process automation and industrial software will have access to Red Hat’s enterprise platforms and application services based on Red Hat Enterprise Linux, allowing them to grow faster and with more agility. The Green Software Foundation, established earlier this year by businesses and NGOs such as Microsoft and the Linux Foundation, has taken on the challenge of making the sustainable coding movement the norm. Green software standards and practices are now being established across a wide range of computer professions and technological areas. Starbucks’ growth there was slow going for a few years after the company first entered the Chinese market. When they started providing health insurance for their workers’ families, they realized they had found the solution. As a result, sales took off, and now Starbucks is one of the world’s most rapidly expanding companies, with over 2,000 locations in one of the world’s most dynamic economies.

A study conducted by Boston Consulting Group (BCG) reveals that over 80% of businesses expect to expand their investments in sustainability, with 60% of those businesses considering ESG considerations a major focus or significant criteria for choosing and prioritizing digital projects.

As per a BCG study done by over 850 companies around the globe, One-quarter of businesses prioritize ESG in their digital transformation, but that number jumps to over half in the medical, biomedical, and automotive sectors (for telecommunications, software, fashion, and luxury). Even in trailing areas like telecom (38%) and software (64%), digital leaders place a premium on ESG.

RELEVANCE TO THE INVESTORS

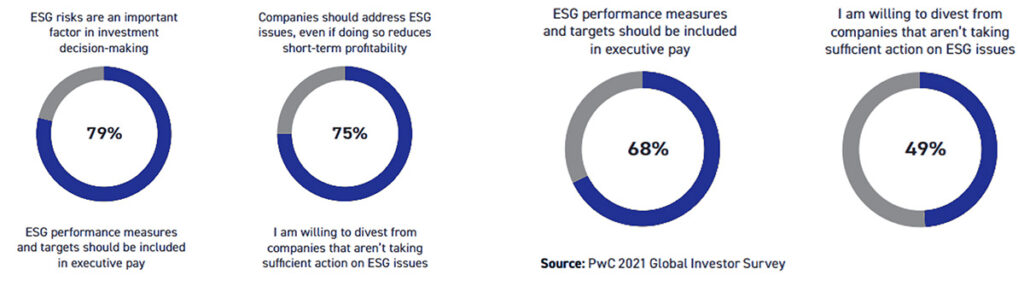

Investors’ growing interest in firms’ efforts to improve their environmental, social, and governance (ESG) performance has put reporting front and centre. Investors are using sustainability reports and establishing investment screens based on standards that measure anything from emissions levels to human rights to diversity in the boardroom. As per a survey conducted by PWC last year, Investors are ready to take action in response to the environmental, social, and governance (ESG) risks and opportunities faced by the firms in which they have invested. Over half were prepared to withdraw from firms that didn’t take enough action on ESG concerns, and 80% stated ESG was a consideration in their investing decisions. Seventy-five per cent of the investors felt that corporations must sacrifice short-term profitability to advance environmental, social, and governance (ESG) problems. However, as discussed before, about the same proportion (81 per cent) said that they would be willing to accept a 1 per cent or less reduction in their investment returns to accomplish these goals. Nearly two-thirds of them refused to accept less remuneration.

Attitudes toward ESG risks and opportunities, % of respondents

To combat the environmental and financial stresses of the present, businesses need to move quickly and efficiently in the direction of more sustainable consumption and production. While some organizations have automated their ESG procedures, others are still using manual methods. Sustainable Development Goals (SDGs) were created by the United Nations to promote global prosperity as industry and economies began to take action against environmental deterioration. However, Goal 12 of the 17 is highlighted as the one that should be prioritized by corporations and organizations: ensuring sustainable consumption and production.

The effects of digital technology are apparent to see across the spectrum of commerce. Since workflows and procedures no longer need to be done manually, operational expenses and human mistakes are minimized.

Roadmap for Converging ESG Goals With Digital Transformation

Disruptive technologies play a major role in all industries when it comes to reevaluating corporate models and establishing new solutions that shape how firms participate in business and analyze their ESG impact. Adopting approaches that not only satisfy digital demands inexpensively but also ease the collecting and reporting of ESG indicators may help organizations better accomplish their ESG goals while simultaneously progressing their digital transformation initiatives. When it comes to reassessing corporate models and developing new solutions that mould how businesses engage in business and evaluate their ESG effect, disruptive technologies play a central role across all sectors. Organizations may better achieve their ESG objectives while simultaneously advancing their digital transformation efforts by adopting methods that not only meet their digital needs affordably but also facilitate the gathering and reporting of ESG metrics. The organization’s selected technological solutions should provide a framework for assessing and enhancing the organization’s environmental, social, and governance (ESG) effect, in addition to improving business operations. When implemented properly, these techniques may greatly benefit an organization, but only if workers are given the information they need to fully embrace the digital transformation and ESG goals of the firm.

Care about global warming, increasing social responsibility, and embracing improved governance practices are core tenets of ESG, and they are directly related to the increased control that digitalization brings to the production chain. And in this process of Digital Transformation and adaptability to societal norms and expectations, technology is a company’s finest friend. Taking a more proactive role in addressing social issues that affect everyone, ESG has emerged as the next business transformation in response to the requirements of society. This means the charge will be much more pointed in the years to come, and businesses that ignore this risk running into trouble. The intertwined nature of ethics and technology necessitates that sustainable and responsible firms include ESG goals in their digital transformation plans. Modern technology enables instantaneous, far-reaching adjustments.

To better respond to the prolific swings in conditions and goals, companies must inevitably use technology solutions that may help them execute operations more efficiently, raise the quality of their deliveries, and facilitate the integration of their systems and personnel. As a result, companies and society as a whole may take more strategic and beneficial actions attributable to the convergence of the two. Companies need to factor these requirements into their digital transformation strategy if they want to provide results that ensure customer satisfaction.